Bitcoin and cryptocurrency are often lumped into one category, and the words are even used interchangeably by normies. In my opinion, when you look at bitcoin vs crypto, bitcoin and crypto are two different things.

I didn’t always believe this! Not too many years ago, I believed in a “multi-coin world”, where people would own and trade various types of cryptocurrencies in a competitive market. I even owned cryptocurrencies other than bitcoin!

Then I did my homework. I started spending more time reading, listening, and studying, and came to the conclusion that Bitcoin was the thing, and crypto just wasn’t it.

I’ll get into specific reasons below, but my main takeaway from these years in the market is that bitcoin is digital money, while crypto is an investment in individual companies. Bitcoin is sufficiently decentralized and distributed, and has an unstoppable network effect that makes it effective global money. Crypto tokens are essentially startup companies issuing equity to investors to develop a product.

Why Is Bitcoin Valuable, But Crypto Is Not?

Bitcoin Is Decentralized

Bitcoin is the most decentralized cryptocurrency in the world. It has the most miners, the most nodes, the most developers, the most owners, and the most daily value transferred of any cryptocurrency. What’s great about Bitcoin is that anyone can participate in the network, no matter who you are or where you are in the world.

There is no application or hiring process to work on bitcoin. There are no education requirements. The only barrier to entry is skillset. The only resource requirement is motivation. The only prerequisite to contributing to bitcoin is that you have a desire to get started.

Bitcoin VS Crypto Decentralization

There are some cryptocurrencies that are somewhat decentralized. For example, you can run a Dogecoin node or mine Litecoin. The differences between these types of cryptocurrencies and Bitcoin comes down to the numbers, i.e. how many people actually mine Litecoin, and how many people actually run a Dogecoin node? Usually, it’s not very many, meaning the network is vulnerable to attack.

For the vast majority of cryptocurrencies out there, it’s near impossible to run your own node or mine due to cost and complexity, or even design. You need expensive equipment and a high level of technical expertise, insider approval, or an existing cache of funds for “staking” to be part of the network.

Crypto paints a wonderful story about financial sovereignty and global finance, but in reality, the main use case for many cryptocurrencies seems to be trading for profits, not sovereign custody of digital cash. In practice, nobody really cares about the tech, as long as they can get rich trading shitcoins.

Without a globally distributed group of diverse network participants, your crypto is not decentralized.

There are lots of ways in which altcoins break, but the main thing to notice is that they break and break often. This is because centralized things are very fragile.

Jimmy Song | Killing DINOs

*Ethereum advocates will claim that Ethereum is on par, or surpassed bitcoin in value transfer, but this is due to tokens built on top of Ethereum, not Ethereum itself. The same principle applies to the number of developers.

Bitcoin’s Multiple Layers Of Security

Bitcoin also has several “layers of security” that have developed over the years, with entrenched participants of the network ready to defend bitcoin, since their livelihood depends on it. For example, public bitcoin miners will advocate for pro-bitcoin policies. Municipalities with bitcoin on their balance sheet will become bitcoin-friendly jurisdictions. Individuals who own bitcoin and businesses who accept bitcoin will use both physical and mental resources to promote the network.

Even though each participant in the network has different incentives, everyone aligns on the desire for bitcoin to succeed.

With cryptocurrencies, these things don’t exist or exist to a much lesser degree. Since the vast majority of crypto holders are here simply for the gains, it doesn’t matter if they’re trading Cardano or Solana. It takes zero effort to sell your position and start trading Chainlink and Tron. The price still goes up and down. People don’t actually use these things for their utility. They just trade them for profits.

The Incentives Of The Bitcoin Network

Getting into the weeds a bit, Bitcoin is also decentralized because of the way the network actually functions. Nodes, miners, and developers all have different roles and incentives. They are all both adversarial and cooperative.

Developers can write and publish code for bitcoin, but the nodes do not have to accept it. Miners can publish any type of blocks they want, but nodes are required to validate them to ensure they follow the rules of the network. Nodes can’t mine and most node operators can’t code. Nodes depend on devs to write and ship code. Devs depend on nodes to run the code. Nodes depend on miners to create blocks with transactions, but miners can’t force nodes to validate their blocks. Each participant in the network is mutually dependent.

Major cryptocurrency chains have experienced accidental chain splits, forced hard forks, and block reorgs in recent years due to their lack of proper decentralization.

There is currently more than one implementation of bitcoin and no limit to who can create their own. This means you can write your own bitcoin software in your own coding language, and as long as your node is in consensus with the network, you can participate.

Mining is decentralized because you can use any type of energy input you want. There are bitcoin miners in the oil fields of Texas competing with geothermal miners in Iceland. Bitcoin mining is not reliant on a single country, a single political regime, or a single type of energy source.

Related Content

Bitcoin Is Distributed

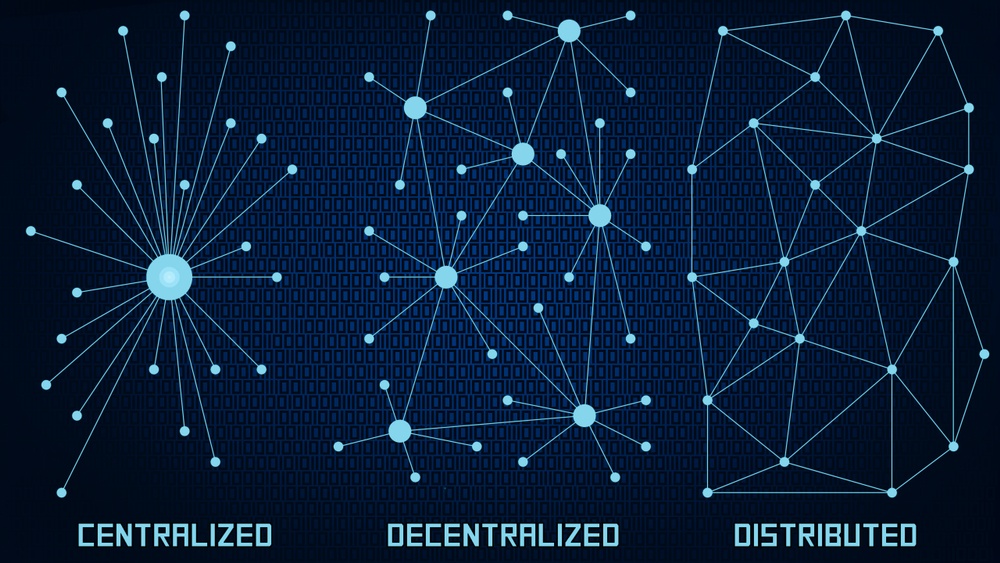

“Decentralized” and “distributed” are often used interchangeably, but they mean different things. Let’s look at what each means.

When a cryptocurrency is decentralized, it means the operations are not centrally controlled in a single location or by a single entity. I see Bitcoin’s decentralization existing in two areas.

First, there are different parties involved in network operations. The miners, coders, node operators, hodlers, and businesses building on bitcoin are all working with different incentives in mind, but are still contributing to the same project (The Bitcoin Project). While a mining business in Europe is advocating for proof of work regulation, a politician in Mexico is pushing legislation to accept bitcoin as legal tender, and an American business is building a bitcoin retirement fund for his clients.

Second, anyone in the world has access to it to these functions. This is location-based decentralization. The inputs for miners, coders, and users originate from different locations, but are all equally considered. Two different individuals working on bitcoin’s code can exist in different locations, yet they can equally contribute to bitcoin development. Various miners exist around the world work to create blocks, and the network is not reliant on one central entity.

Distributed Networks Are Attack-Resistant

Bitcoin being distributed, as in a “distributed network” means that validation occurs as a result of sufficiently connected nodes. There are enough nodes connected through a web of peers to make it impossible to take down the network. Each node in

Bitcoin connects to only a few peers, but by repeating those connections over and over again, nodes are able to reach a consensus so that more than 50,000 entities can agree on the rules. It’s not that each node connects to tens of thousands of peers, it’s that there are enough smaller chains of connections to reach the whole network.

If one node goes down, the Bitcoin network is not broken because enough other, redundant connections exist to maintain consensus.

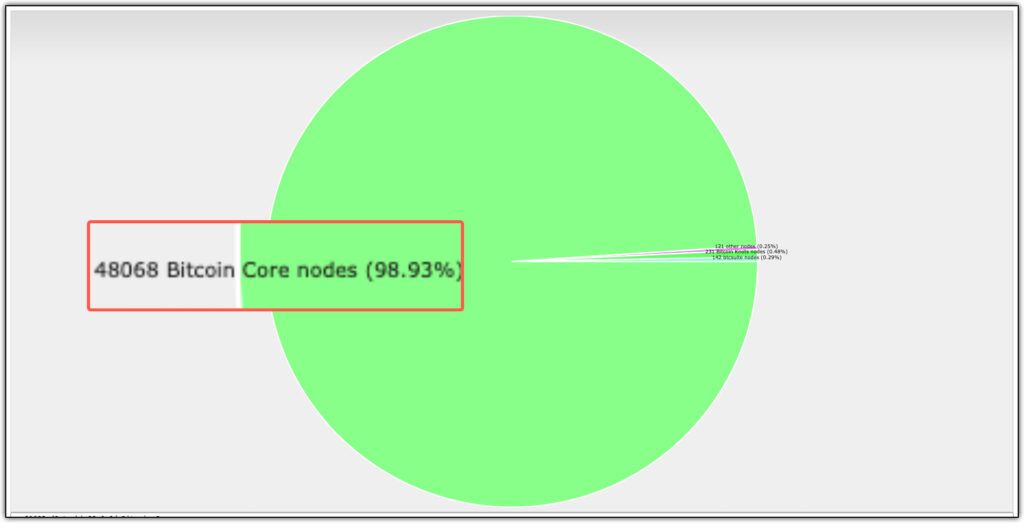

As of right now, there are around 50,000 nodes on the bitcoin network. That’s FIFTY THOUSAND different entities verifying transactions on the Bitcoin blockchain. If one, or even a thousand nodes go down, Bitcoin will still function properly.

Compare that with some of the other popular blockchains out there. These are from the top 10 cryptocurrencies by market cap, so you can imagine how bad things look once you get lower down on the list.

In fact, Solana’s nodes are run exclusively by the Solana Foundation, and they are the only entity actually writing code for the blockchain. That doesn’t sound very decentralized or distributed to me!

It Is Easy And Cheap To Run A Bitcoin Node

Part of bitcoin’s success as a distributed network is the ease of participation. Running a bitcoin node, costs just around $200-$300, then 1-2 hours to set it up, and you can run it on your home network without sucking up too many resources.

Contrast that with other cryptocurrencies out there which often require technical expertise and professional grade equipment, plus the associated maintenance time and costs.

Overall, what you have in crypto is systems that are difficult and expensive to maintain, centrally controlled by a few elite, wealthy maintainers of the system. Often, this group of people is financially incentivized to make changes to the system and users are powerless to resist these changes.

Bitcoin Was Fairly Launched

Bitcoin has the proper incentives aligned to run a neutral money network. When bitcoin was launched, there was no such thing as “cryptocurrency” yet. Throughout all of 2008, and most of 2009, bitcoin didn’t even have a price. In fact, once you factor in the cost of electricity needed to mine bitcoin on your laptop, bitcoin was worth less than nothing.

For this reason, the first group of people who were mining and transacting in bitcoin were not doing so for financial gain. There were no “insiders” with pre-mined coins to dump coins on retail investors. There was no Bitcoin Foundation with a 10% stake, or developer trust to guarantee payment for those writing the code.

When bitcoin was a baby, it was in the hands of those who cared about its success due to altruism, ideology, or just plain curiosity.

When Altcoins Launch, Look At The Premine

With altcoins, this is definitely not the case. Point to any recent altcoin launch, and you’ll see that they almost always go through an investment round, where venture capitalists commit money to funding a project. Of course, this means investors get access to early tokens, often at a price lower than what’s offered to the public. This money is then used to pay developers, social media shills (literally), marketing campaigns, and other efforts to hype their coin project. Growth is far from organic.

Everyone is trying to make the next bitcoin, but the environment in which bitcoin was invented and developed can never be recreated. It’s a catch-22. If a coin gets no attention, it’s got no chance of survival amongst an ocean of 10,000 other popular alts. If a coin gets too much attention but is not centrally controlled, it’s vulnerable to attack. If it’s centrally controlled and protected, then it’s not a neutral global money, it’s a startup.

It’s impossible for any other coin to repeat Bitcoin’s organic growth process and honest incentives.

Why is this important?

Money should be neutral and reliable. When you have a small group of people who are in control of a large amount of funds and running a proof-of-stake network, where more funds = more power, it means those people influence how your money works.

When you have a small group of developers pushing out code that everyone is forced to accept, in the digital realm, it means ultimately, they control your money. VCs backing these projects can equally pull the strings behind the scenes, and there’s really no point in moving away from a money manipulated by government into a money manipulated by wealthy tech insiders.

Then they laugh as the price pumps and they dump their tokens on ignorant retail investors.

Cryptocurrencies are launched like Silicon Valley startup companies with the idea that a small group of people will fund and grow these projects, then sell them for a big fat payday upon exit.

Why Will Bitcoin Succeed, But Crypto Will Not?

The Massive Network Effect Of Bitcoin

Bitcoin has the first mover advantage, meaning for a long time, they were really the only game in town. It’s not like Uber and Lyft which were launched around the same time. Namecoin wasn’t launched until 2011, and that’s a dead project now. Litecoin was launched shortly after, and while it was the #2 crypto for a while, it’s now fallen to spot #20.

For the entire lifetime of crypto, it’s been bitcoin versus everything else.

More people own bitcoin and more businesses accept bitcoin than any other cryptocurrency. More people trust bitcoin. Bitcoin’s network effect is unparalleled.

Bitcoin Will Still Be Here In 20 Years

Its popularity, trust, and effectiveness as a money is how it’s able to maintain its decentralization, and therefore its value. This means miners still have an incentive to invest in mining equipment and mine bitcoin because they know their business can rely on the industry in the future. Developers have an incentive to hone their skills and stay within the bitcoin network because they know it’ll be around in 10 or 20 years.

Users are incentivized to invest time and resources into learning about, buying and finding proper custody solutions for bitcoin rather than just trading colorful tokens.

All of this activity around bitcoin means that bitcoin business and bitcoin related services can thrive, compounding bitcoin’s network effect. The success of bitcoin leads to the success of these individual participants in the network, and that incentivizes other users to join, thus growing the network and repeating the process.

Crypto Needs A 10x Advantage

“Crypto” is often lumped together as one entity, but in order for a single cryptocurrency to compete with bitcoin and become more popular as a digital asset, a single project would need at least a 10x advantage over bitcoin.

Switching money is not the same thing as switching social networks. Bitcoin is not the Myspace of crypto as some claim. If I invest my family’s wealth into bitcoin with the mindset that I’m going to leave it there for decades as a retirement fund, or even as an inheritance for my children, slightly faster block times or a modified issuance schedule for new coins is not going to convince me to move my funds over to a new network.

Let’s be clear – there’s nobody disputing the fact that Bitcoin is currently the largest, most trusted, and most used cryptocurrency. The debate is about what the future looks like. My point is that in order for that future to change, there has to be some kind of groundbreaking change to the upside for a crypto project or some kind of catastrophe for Bitcoin for the current state of things to change.

As the entire crypto ecosystem moves forward, smart money will continue to allocate to bitcoin, and the dumb money will load their bags with tokens, while praying for a moonshot. For those who do hit the jackpot, they’ll sell at the top, then buy bitcoin.

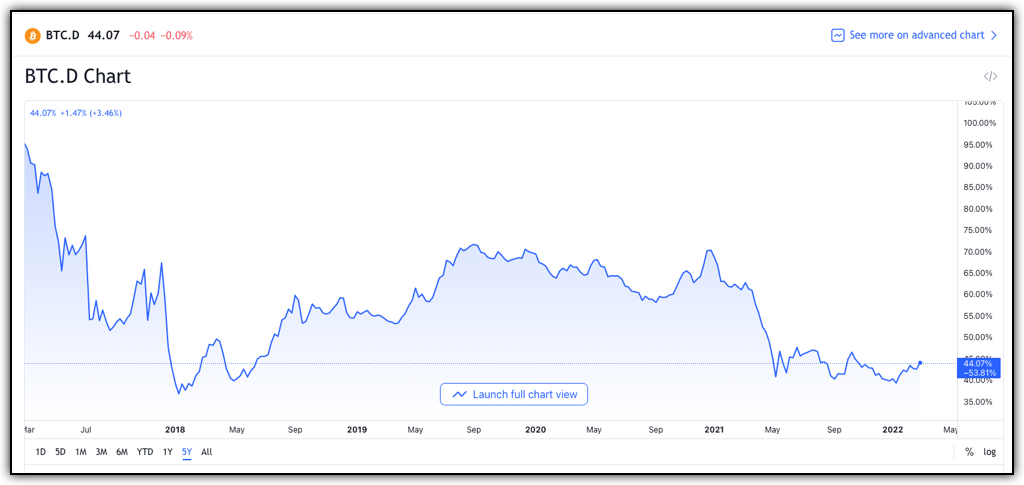

Despite what you hear about so-called bitcoin dominance (shown below), this is a wonky metric that doesn’t really describe market conditions.

Looking at the chart, it seems that Bitcoin dominance is down, which means crypto is overtaking bitcoin. No.

Bitcoin Versus Everyone Else

What this doesn’t tell you is that this is Bitcoin versus the entire crypto market. For bitcoin to lose its position as the dominant digital asset, a single coin would have to compete and overtake bitcoin. This chart also doesn’t tell you that anyone can launch a coin and give it a market value. With more coins being launched and more “new money” coming into the market due to crypto exchanges doing more advertising, the size of the market is growing.

A more interesting chart would be bitcoin’s dominance compared to proof-of-work mining coins. That would be something like 90%+. What you should be asking is how many people are holding which coins for more than a year. Also, my guess would be that would be clearly dominated by bitcoin.

Normies can trade in and out of alts all day and it doesn’t take away from bitcoin’s advantage as the only reliable choice for long term value storage.

Crypto Incentives Are Clear

The incentives to launch a cryptocurrency are clear. It’s very similar to starting a tech company.

You have an idea and you pay people to code up your idea. You launch the project, keeping a certain amount of equity for yourself. You pay a marketing team, build a product, and if everything is successful, you start selling your insider holdings as the price goes up.

Starting a cryptocurrency is not about starting a new type of money to compete with bitcoin. Bitcoin has already won. Nobody wants to compete with bitcoin, so they pick some bullshit niche narrative like tokens for animal shelters, banking weed companies, paying sex workers, NFT games, or whatever else so that they have some kind of story to sell. There’s no such thing as a bitcoin killer.

It’s hard to even call these things cryptocurrencies because basically what they are is companies.

The goal of these companies is not to build a decentralized network of unstoppable money. Their goal is to launch a popular product and make money.

What About A Multi-Coin World?

There was a period in the past when I believed in a “multi-coin world”, where there would be thousands of different cryptocurrencies, all competing and offering different advantages for different situations. You could use Litecoin to buy your coffee. You’d use Monero for privacy. You’d pay for data storage with Filecoin, and buy weed with Potcoin.

I imagined that wallets would hold these coins and you could program your wallet to invest based on a trading strategy, executing buy orders for dips, and auto sell after pumps. This would be great for tax loss harvesting!

Then I thought about my incentives, and how much it would suck to live in that world.

Nobody Wants To Be A Crypto Trader

Would I really want to own 40 different types of cryptos and worry about the price of each one every day? Would I really do the research to figure out if these coins were secure and adhered to the rules and roadmap they laid out in the whitepaper? Could I really trade profitably on a regular basis, and out-trade everyone else if we’re all using the same algorithm?

The answer to everything was, “No”.

I just can’t see how a multi-coin world would function. Would you really research 200 coins to narrow it down to a top 3? Most people can barely listen to me speak 5 minutes about bitcoin, so how is the average person going track multiple coins and manage their money for coffee payments or TV subscriptions? At the end of the day, everyone is just going to want bitcoin and be done with it.

Bitcoin is a secure network, with predictable rules, and immutable transactions. People don’t want to be crypto day trader.

But Alts Go Up Faster Than Bitcoin!

One of the most frustrating aspects of the altcoin propaganda market is the idea that altcoins “go up” faster than bitcoin, so you should buy alts into a bull market, then trade for bitcoin during a bear market. Easy right? Not really.

First, you have to pick the right alt, at the right time, and sell it at the perfect time during the price pump. Who could have honestly guessed that Dogecoin would go parabolic in 2021? Who could have predicted that Shiba Inu would 1000x in a less than a month, when there are a hundred other dog coins like Doge Dash, Doge Cola, Dogelon Mars, and Dogebonk? Or what about Baby Shiba Inu or Alien Shiba Inu? The next God Tier Pump could be one of these projects!

It would just be such an astronomically lucky roll of the dice if you truly owned a significant amount of wealth in any one of these projects… and then you wouldn’t be able to sell it because the market would be so illiquid that any amount of serious selling would trigger a price dump.

Aside from the obvious crapshoot of picking the right coin and the right time and successfully selling into a bull market, look at what you’d actually be doing: SELLING. You’d be selling because you know that alts are worth nothing long term, and you want to get out as fast as possible.

This is the same as every other trader and influencer out there. Alt traders with influencer status know the game. Trade in and out of alts to acquire more bitcoin. With the exception of a few outliers, nobody who’s been in the “crypto” industry has a position in any coin that outweighs their bitcoin position.

All Roads Lead To Bitcoin

Bitcoin is the foundation of programmable money. People see bitcoin as a “token”, but really, it’s a protocol. It’s the language of digital money, and everyone around the world is going to speak the same language out of convenience.

This is how the internet works. When you get on your browser and type in a web address, you can see the text and images, and interact with the page because your browser knows how to speak a specific language: HTTPS over TCP/IP.

HTTPS, built on top of TCP/IP is the universal language of the internet, and it’s how we are all able to log into the same system and share information across the world.

Bitcoin is this, but for the language of digital value.

Bitcoin Is The Standard For Digital Money

Bitcoiners are promoting the standardization of the language of value transfer, and so far, they are winning. Everyone knows what bitcoin is. If you accept digital money, it’s going to be bitcoin.

Also, like the internet, Bitcoin allows for “building second layers” on top of it, for more complex functionality, and we are seeing that built out with projects like Lightning and Liquid. Any cool features you see as part of your altcoin project can eventually be built on top of bitcoin. This allows for a highly secure, standardized foundation, with upper layers able to be more centralized, experimental, and expressive.

What’s cool about being the global language of value and being a permissionless system is that you have more people on your team. Bitcoiners are located in every country in the world and are growing in number. If you are pro-Bitcoin, then you are adding value to Bitcoin’s network, even if your only contribution is buying, holding, and evangelizing.

On the other hand, crypto is a splintered movement. When you hold Ether, you aren’t holding Cardano. When you code for Polkadot, you are taking resources from Chainlink.

People will eventually figure out that these crypto companies come and go, but bitcoin will always be here. Bitcoin is the foundation of the crypto ecosystem. ALL ROADS LEAD TO BITCOIN.

Video: Experimenting On Bitcoin Using Drivechains

Video: Spacechains

Spacechains from Advancing Bitcoin conference on Vimeo.

Final Thoughts: Digital Scarcity Was A One-Time Invention

Bitcoin was a one-time invention that can be iterated on, but not recreated. In an alternate universe, perhaps Bitcoin was programmed differently, but the result would be the same: digital scarcity. Digital scarcity is what allowed us to use bitcoin units as digital value.

Money has value because it exhibits the properties of money, not because it’s “backed” by anything. Money stores and transfers value because of its inherent qualities (portability, divisibility, durability, verifiability/recognizability, fungibility, scarcity). Money is the origin of value, not a derivation of it, and Bitcoin is digital money.

Bitcoin was launched. It worked. It continues to work. You can iterate on top of bitcoin, use it for new applications, and improve bitcoin over time, but there is no next bitcoin, just like there is no “next wheel”

The funny thing about bitcoin and crypto is that if crypto fails, bitcoin can still succeed. Bitcoin doesn’t need crypto. If bitcoin fails, however, the crypto story is dead. There is no crypto without bitcoin.

Further Reading & Listening

- Podcast: Augmenting Bitcoin With Samson Mow

- Article: Altcoin Delusions (Bitcoin Magazine)

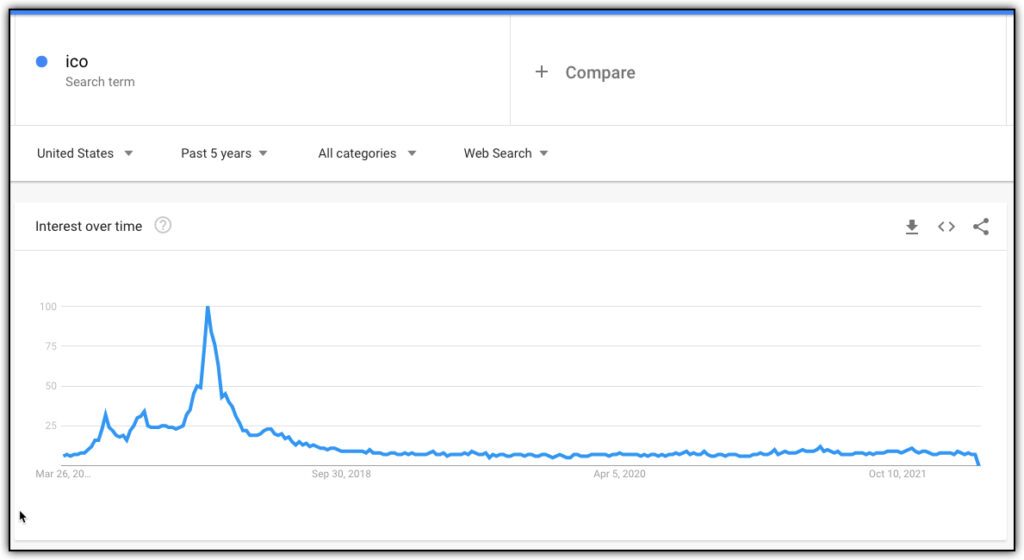

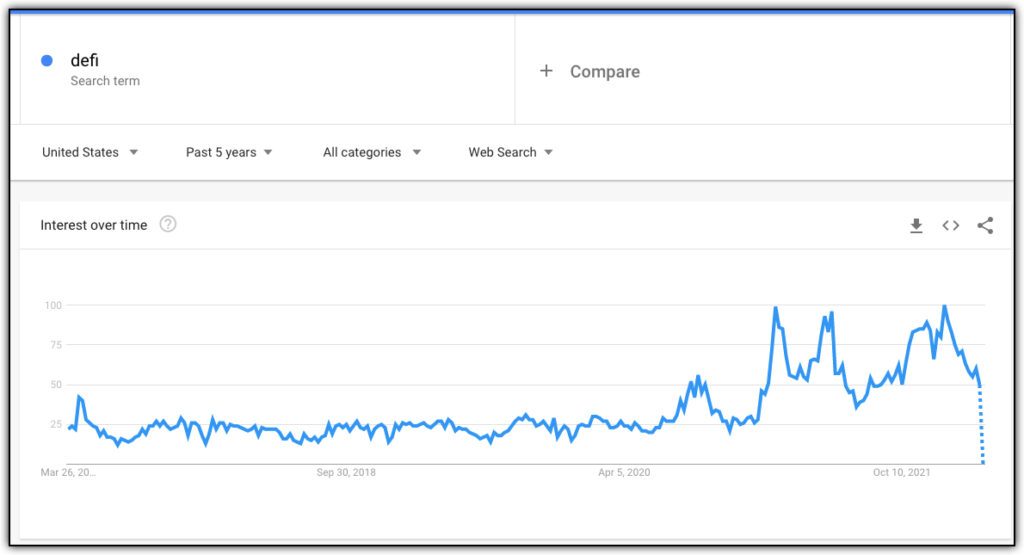

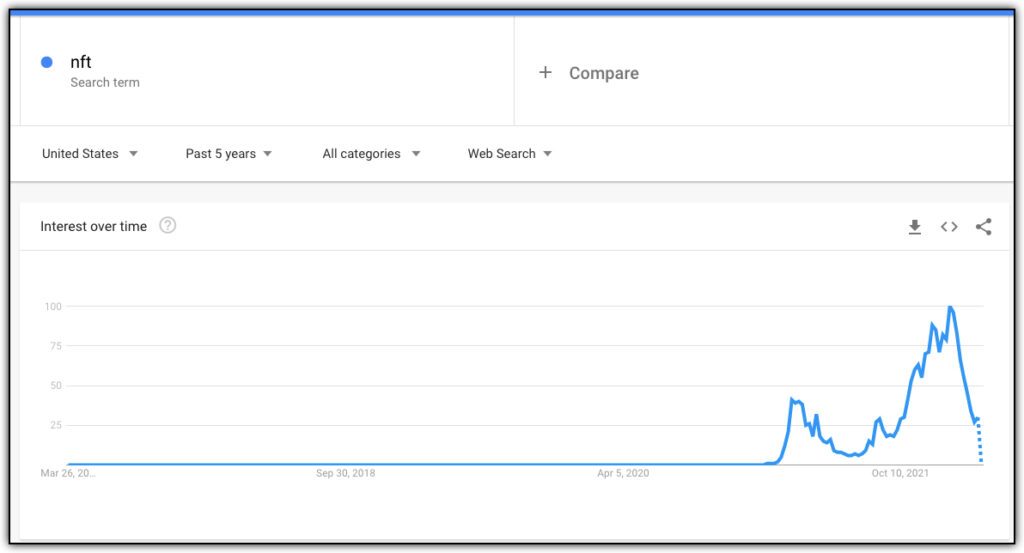

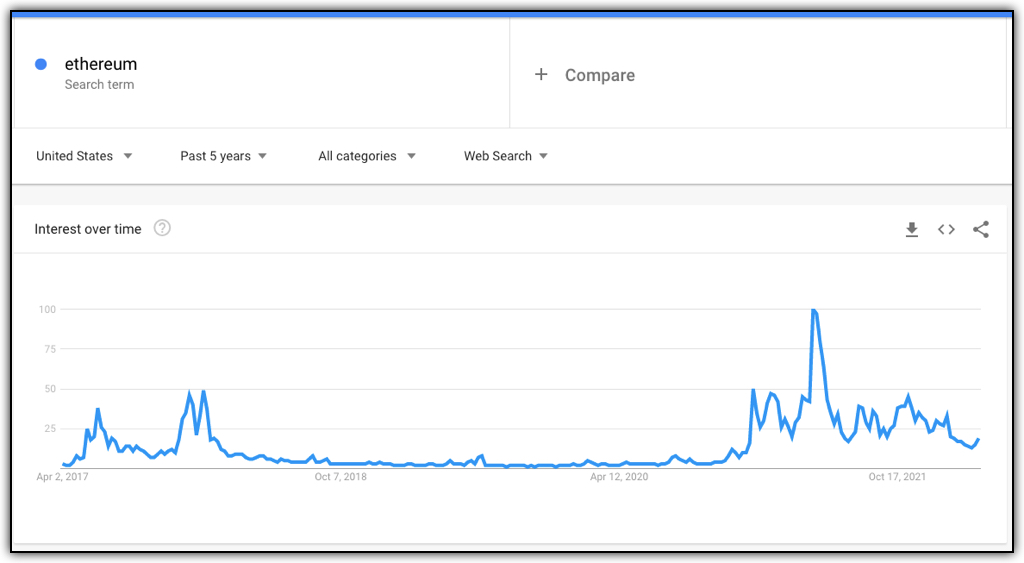

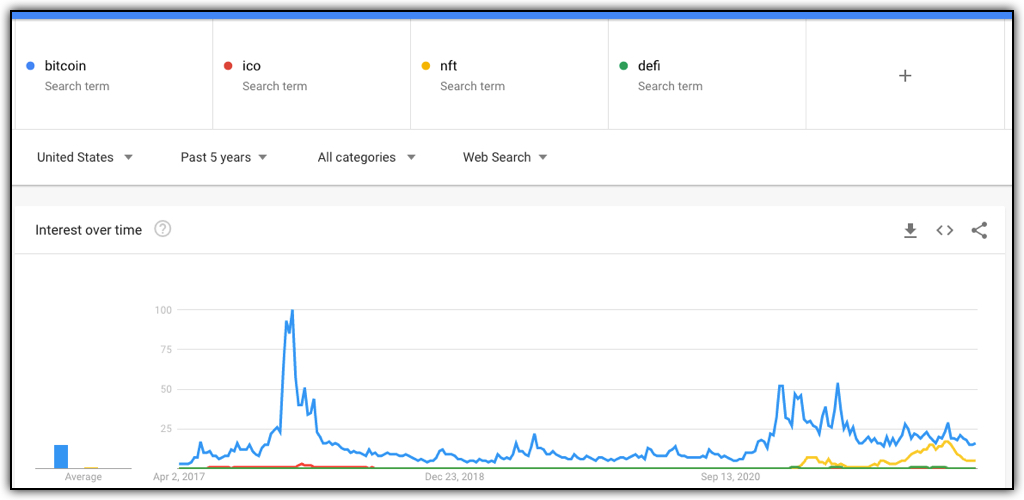

Google Search Trends For Crypto

Frequently Asked Questions

Is Crypto The Same As Bitcoin?

In mainstream media, you’ll often hear crypto and bitcoin used interchangeably, but to many bitcoiners, they are starkly different asset classes. Bitcoin is generally considered one of many cryptocurrencies, though its properties make it a unique cryptocurrency unlike any other, so many, including bitcoin maximalists, make a priority to differentiate between the two.

Which Crypto Is Better Than Bitcoin?

There is no crypto that better than bitcoin. Though some claim to have faster transaction speed, be more environmentally friendly, or other unique features, many of these claims are untested, and it’s not uncommon to have statistics manipulated to push a false narrative. The fact is there are very few people, even of those deeply involved in crypto, who would claim that bitcoin is not the #1 cryptocurrency and likely to remain that way.

How Is Bitcoin Different From Other Cryptocurrencies?

Bitcoin is different from other cryptocurrencies in that it is permissionless to build on and cheap/easy to run your own node. This means it’s easy to verify the supply of bitcoin and the validity of incoming/outgoing transactions without using a trusted third party. It’s also the most widely accepted and transacted of any cryptocurrency, making it the most frequently stress-tested crypto asset.

Why Buy Crypto Other Than Bitcoin?

Though I don’t recommend investing in any crypto other than bitcoin, there are some bitcoiners who enjoy gambling and want to make some short term bets on directions of certain coins. Some buy coins hoping for bull market pumps to outperform bitcoin’s price gains, and some short projects they think will experience imminent failure. I recommend you look at this type of activity as gambling and not investing.

Why Did The Bitcoin Price Drop?

Why Did The Bitcoin Price Drop?

Leave a Reply