Coin control is a feature in some Bitcoin wallets (the good ones) that allows users to select which specific “coins” you want to use in a transaction. If you weren’t already aware, every amount of bitcoin you have received in the past is segregated as its own “piece” of bitcoin. Though you can spend a portion of this amount of bitcoin and receive that difference back to your own wallet, or combine multiple pieces for a larger transaction, understanding what coin control is requires that you understand that the total balance of bitcoin shown in your wallet is actually a combination of multiple pieces of bitcoin you have received over time.

It’s a little like having multiple bills of cash a wallet, except there is no standard denomination in bitcoin. So while you may have $50 worth of fiat cash in your pocket made up of a $20 bill, a $10 bill, and four $5 bills. In the same way, though your bitcoin wallet with 丰2,500,000 sats might be made of 丰1,235,679 + 丰5040 + 丰101,069 + 丰1,158,212.

Using coin control in bitcoin means you can individually select which set of coins you can spend from. For example, if you buy something that costs a million sats, you could spend from the 1,235,679 unit or the 1,158,212. Depending on how much you pay in fees, you’ll have some portion of leftover bitcoin sent back to your wallet as “change” into a new portion of bitcoin.

Continuing with the example above, if you were to buy something for 2 million sats, you’d have to combine two or more of the bitcoin units until you had enough to pay for the item + fees.

Notice, I keep using the term “bitcoin units” or “portions of bitcoin”, but there’s an actual word for this called UTXO (Unspent Transaction Output), so I’ll use the correct term as we continue exploring what is coin control, how to do it, and why you should care about it.

Why Should You Care About Coin Control?

Coin control gives users more granular control over their transactions and can have various implications for privacy, transaction fees, and coin aging. Here are some reasons why coin control might be used:

- Privacy: If you have received small amounts of Bitcoin from various sources and then combine them to send a large amount using all those small inputs, someone analyzing the blockchain could infer that all those inputs belong to the same person. By selectively choosing inputs using coin control, you can manage your transaction’s privacy footprint.

- Transaction Fees: Transaction fees in Bitcoin are based on the size of the transaction in bytes, not the amount of Bitcoin being sent. Transactions with many inputs can be larger in size and therefore more expensive. By using coin control, a user can select fewer or more efficient UTXOs to reduce transaction size and fees.

- Coin Consolidation: Small amounts of Bitcoin, often referred to as “dust,” might be uneconomical to spend because the transaction fee could be higher than the amount being transacted. Coin control can be used to manage or consolidate these dust transactions.

- Coin Aging: Some users might want to spend older or newer coins first for various reasons, such as tax implications. Spending an older coin may give you a lower percentage tax rate, but spending a new coin may have lower overall taxes. Coin control allows for this by letting users pick which specific UTXOs to use.

Privacy

Privacy is probably the most important, yet most underrated benefit of using coin control. What most new bitcoiners don’t consider is that all of their bitcoin activity is trackable on the public blockchain.

Even if you take the stance that you don’t really care if companies and governments track you because you’re not doing anything interesting or illegal with your bitcoin, consider that the blockchain keeps a record of everything forever, so your actions now could have future consequences.

Consider that in the future, it may be easier for individuals, including criminals, to use bitcoin blockchain analysis to exploit or exploit you.

By understanding coin control and learning to learning to use it properly, you can identify where a coin came from, and have some consideration when spending it.

Let’s say your friend sends you 200,000 sats to pay for their half of dinner and drinks. Then your boss pays you 4 million sats for your paycheck (paid in bitcoin, of course). The next week you call in sick, but you aren’t really sick. You go to a local coffee shop that accepts bitcoin and you buy a coffee.

If you spend from the 4-million-sat stack, your boss will be able to see that on-chain transaction when it clears. Maybe they are savvy and know that the wallet receiving the bitcoin was that particular coffee-shop-that-accepts-bitcoin, and they put it together that you were out having coffee on your sick day instead of at home in bed. So you decide to buy your coffee for 丰13,000 from your 200k sat stack instead of from your 4-mil sat stack, and your boss doesn’t see any sats leaving from the bitcoin he paid you.

Of course, this is a far-fetched scenario for a number of reasons, including getting paid in bitcoin directly from your company, or your boss being bitcoin savvy and also insane enough to invade your privacy by tracking the blockchain when you call in sick, but the example illustrates a simple point of how someone sending you bitcoin can then track where that bitcoin goes over time.

There are other ways to mitigate privacy issues with bitcoin like using coinjoin, but let’s not get too far off into the weeds. Hopefully that’s clear why coin control is important for privacy.

Transaction Fees

Coin control is also important for saving on transaction fees. With bitcoin, you pay to use the network, and those fees are calculated based on how much data the transaction requires, in combination with a public bidding system to get your transaction included in block by the miners. Coin control is important for managing transaction fees for two reasons.

The current, and most relevant reason at the moment is to save on fees when you spend bitcoin. In short, the more inputs you use in a transaction, the more it costs to send. If you spend 丰100,000 made up of 10 UTXOs, each 丰10,000 each, the cost to send this transaction will be higher than if you spend a single UTXO of 丰100,000.

By knowing the size of your coins, you can manage which coins you spend, when, to save yourself on fees. A more expensive cost could be spent from a bigger coin, and when you spend pocket change on something you can use up your smaller UTXOs.

You’ll likely always have some sort of change leftover after a transaction, but then you can consolidate those tiny UTXOs when fees are cheap on the network, usually at night or over the weekend in the USA, when fewer people are competing for block space. Consolidating UTXO means that you’d gather up a bunch of small UTXOs and send them to yourself, essentially combining them to a larger UTXO which can then later be spent as a single unit.

Coin Consolidation

This leads us to the other reason to consider coin control.

In the future, we don’t know what the bitcoin fee environment will look like. It’s possible that fees will be much higher than today. It’s possible that fees are so high, that it makes some UTXOs unable to be spent because the fees are higher than the amount of sats contained in the UTXO.

Using coin control, you can better manage your current UTXO set and make plans for the future by consolidating smaller UTXOs into bigger units that would make more sense in a future high fee environment.

Of course, combining UTXOs will be visible on chain, so it’s important to know which bitcoin came from where. By labeling individuals coins within your wallet when you receive them, you’ll be able to make better decisions about which coins to combine.

Coin Aging

There’s no much to expand on here, but the main feature of “aging” your bitcoin is to due to the tax implications of spending bitcoin. An aged coin in bitcoin has no more or less value than any other bitcoin, as all bitcoin is fungible.

However, to the tax man, it does make a difference.

In the USA, for example, any asset held for more than a year is subject to long term capital gains tax instead of short term capital gains tax, and this can make a huge difference your tax bill. Long term capital gains caps out at 20%, but you’ll often end up with 15% unless you make a ton of money. Short capital gains are taxed as regular income, which tops out at 37%, and even if you’re a middle-income earner in the USA, you’ll be paying least 22%.

Of course, paying taxes on bitcoin isn’t very cypherpunk, but it’s the reality we live in, and if you are going to be spending bitcoin at any point, you need to be aware of how to spend your bitcoin in the most tax-efficient way.

What Are UTXOs in Bitcoin?

Imagine your wallet. Instead of regular dollar bills or coins, it’s filled with gift cards (each is a UTXO). Every time someone sends you Bitcoin, it’s like getting a gift card. Each gift card can have a different amount, just like some gift cards might have $10.51, but another could have $50.23, and so on.

When you want to buy something (or send Bitcoin to someone), you might have to use one or more of these gift cards. Let’s say you want to buy a game that costs $30, but you don’t have a $30 gift card. You have a $20 gift card and a $25 gift card.

To buy the game, you’d have to give both gift cards to the store. They’d use the combined $45 to let you purchase the game and then give you a new gift card (a new UTXO) with the remaining $15 on it.

This system might sound a bit more complicated than just having a balance that goes up and down, but it offers certain benefits, especially around privacy and flexibility in transactions

Related Content

Coin Control Features

To utilize coin control, you would need a wallet that offers this feature, but there is no single “coin control” option for bitcoin. Coin control is done at the wallet level, and different wallets offer different coin control features. Some of the more common features include:

- UTXO labeling

- “Locking” coins

- Tagging coins

UTXO labeling is probably the most basic and most common feature, basically allowing you to write a note on the transaction to say where you got it from. If you’ve been in bitcoin for a few years and haven’t been doing this, it’s basically an impossible task to remember every sat you ever bought and where it came from. However, if you are diligent and consistent about labeling transactions as they come in, it will be very useful to have this information in the future as you being to spend or sell those bitcoin.

Locking coins doesn’t really lock them permanently per se, but it makes them unable to be spent within the wallet without manually overriding some settings, or at least ignoring the big red letters warning you DO NOT SPEND. I’ve seen this feature prominently in wallets that integrate with Whirlpool, and privacy-preserving bitcoin tool, so you know which change addresses are not private, and therefore should be handled with care moving forward.

Tagging coins would presumably be used to group transactions with a similar history. This might be useful for consolidating UTXOs in the future where privacy is less important. For example, if you receive a bitcoin payment from your friend every Friday to split a dinner bill, you can then tag these as such, and consolidate later into a larger UTXO. Because these all came from the same origin, for the same purpose, you wouldn’t be sacrificing any privacy by linking them together.

In the future, there may be more coin control features added to your favorite wallet as more users become aware of the benefits of coin control and push to add more options. Personally, I’d like some automated labeling features, such as the ability to automatically tag anything under 100k sats and combine when fees reach a certain threshold.

I also think it would be nice to be able to compare fees on different UTXO options. The threat of “high fees” from combining UTXOs sounds like a big thing to worry about, but sometimes doubling a fee from 1500 to 3000 sats is at this point, just $0.50 to $1.00, and might be worth just biting the bullet in some cases. Why waste my time worrying about 1500 sats (an extra $0.50) when I can just buy 250,000 for $100.

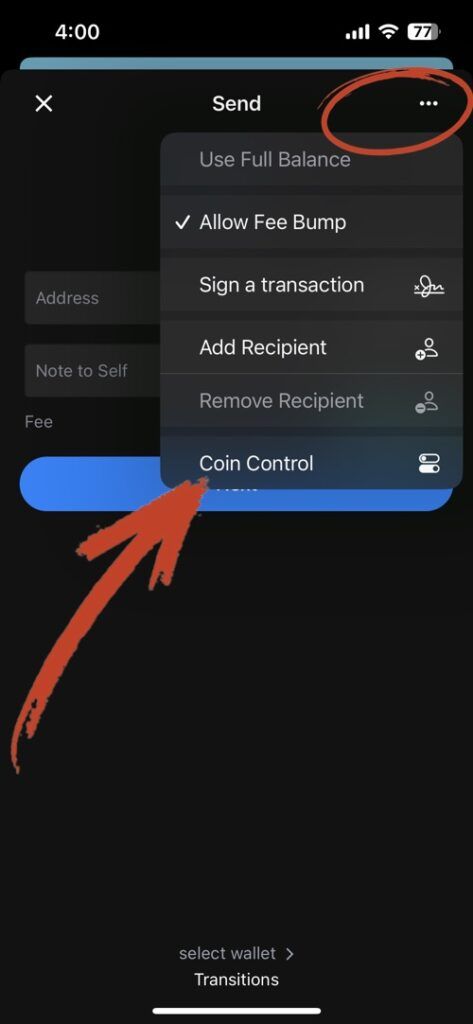

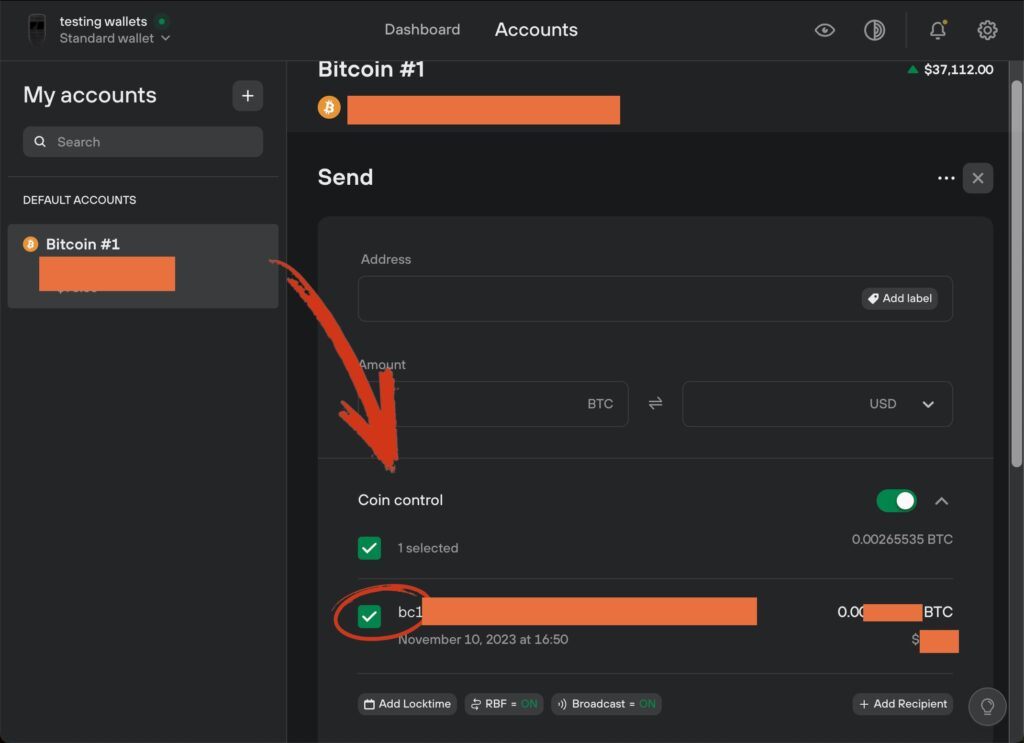

Screenshots Of Coin Control In Wallets

The Trouble With Coin Control

Unfortunately, even if you are very diligent with your coin control habits, they may not translate between wallets. That means if you do something like labeling coins, locking coins, or grouping coins, then you restore your bitcoin to a different wallet, that data may not be transferred.

Of course, not all coin control benefits will be lost. You’ll still have consolidated UTXOs and be aware of which UTXOs you’re spending, but you’d lose anything like labels and tags you created within the wallet.

BIP 329 attempts to solve this by making labeling and other information compatible across multiple wallets, but adoption has been slow as of 2023. It seems like a relatively uncontroversial proposal, and of course implementation will be optional, so I think we will likely see better cross-wallet compatibility in the future, especially as coin control awareness and bitcoin user proficiency increases.

What Happens When You Don’t Do Coin Control?

When you don’t do coin control, your wallet selects the coins for you. Your bitcoin will spend as normal, and everything will operate in the background. If you don’t use coin control, you can still use your bitcoin just fine. Wallets do the job of choosing which UTXOs to spend from, but each wallet has a different policy. Some of the most common ways to prioritize UTXOs within a wallet for users not using coin control are:

- First In First Out

- Last In First Out

- Minimize Fees

- Prioritize Small UTXOs

To be honest, I haven’t personally looked into the wallet policies of spending for any wallets, so I don’t know how common each one is. It’s also possible that there are more complex spending strategies, and with some wallets, you may be able to customize these settings.

First in First Out or Last In First out are pretty obvious options, which just automatically spends coins based on the order in which they were received. Minimizing fees naturally would spend from the largest UTXOs first, or combine multiple UTXOs in a way that would allow you to pay the lowest in fees possible. Prioritizing small UTXOs would basically be a way to clear out any dust or small coins that would be too expensive to spend later. You’re basically biting the bullet now on fees, and saving your largest coins to spend later.

Why Is Coin Control Important?

Coin control is important because it provides users with the ability to micromanage their transactions and understand the distinction between the high-level abstraction of a wallet and the underlying implementation involving individual coins. This concept helps clarify confusion around how digital wallets operate, as many people may not fully grasp the separation between the user interface of a wallet (the abstraction) and the actual discrete units of cryptocurrency (the individual coins) that they own.

Moreover, Wladimir explains that coin control can be beneficial in understanding this difference, which he considers to be even more significant than the detailed management capabilities it offers. Additionally, while multiwallet functionality could be more appropriate for separating identities and avoiding linkage between them, progress on that front seems to be slow. Therefore, coin control serves as an interim solution for users who wish to manage their coins with greater precision.

In essence, coin control provides enhanced privacy by allowing users to select which coins to spend in a transaction, reducing the risk of linking different transactions to the same identity. It also enables users to optimize their transactions for lower fees by selecting inputs with lower priority or age, and can help organize and handle cryptocurrencies more efficiently for both personal use and business operations, especially when dealing with large volumes or values.

Should You Even Bother With Coin Control As A N00b?

When learning about bitcoin, there’s a lot to take in. It can seem overwhelming at times trying to understand all the aspects of this new technology. Understanding how bitcoin works and how to secure your bitcoin is already a massive undertaking – so should you even care about coin control at this point?

Though I believe your #1 goal in learning about bitcoin should be to learn how to safely and securely control the keys to your bitcoin, coin control is a close second. I don’t think it’s important so that you can save money on capital gains taxes or even save money on fees, but I think it’s important to understand how your savings is structured in your bitcoin wallet.

Learning how coin control works leads directly into learning about UTXO management, and just visually seeing the UTXO lined up in my wallet while actually understanding what I was looking at helped me figure out better strategies to stack bitcoin and how to plan for the future.

There are many things about bitcoin that I think you can file under, learn in the future when I have time or interest, but coin control and UTXO management isn’t one of them. If you’ve figured out cold storage, sending and receiving bitcoin, and have a lightning wallet, the coin control should be next on your list to investigate.

How To Buy And Sell Bitcoin For Beginners

How To Buy And Sell Bitcoin For Beginners

Leave a Reply