Bitcoin is a mysterious thing to many people, but the masses are slowly coming around, and investors are starting to say things like just 1% just in case. The thing is, in my opinion there are a couple of very well-defined and attractive benefits of investing in bitcoin beyond beyond just in case.

Once you really start to understand how bitcoin works, you’ll start to see that every asset has tradeoffs.

Bitcoin not only has incredible upside price potential, but it also means you own an uncorrelated, globally traded asset that’s cheap to hold and easy to protect. Let’s look at some of the benefits and drawbacks of owning bitcoin versus other types of investments.

Benefits Of Investing In Bitcoin You Can’t Get With Any Other Asset

1. Being An Early Adopter Means Greater Returns

Bitcoin is pretty much of a one-time thing. Not just ones in a lifetime, but a one-time invention for the human race. It’s global money that cannot be controlled by government. It’s not guaranteed to work, but if it doesn’t work, there is no replacement.

Sure, there are plenty of other “coins” out there, but those pretty much all pump-and-dump schemes launched by tech startups and individuals looking to dump on get-rich-quick speculators. They are not bitcoin.

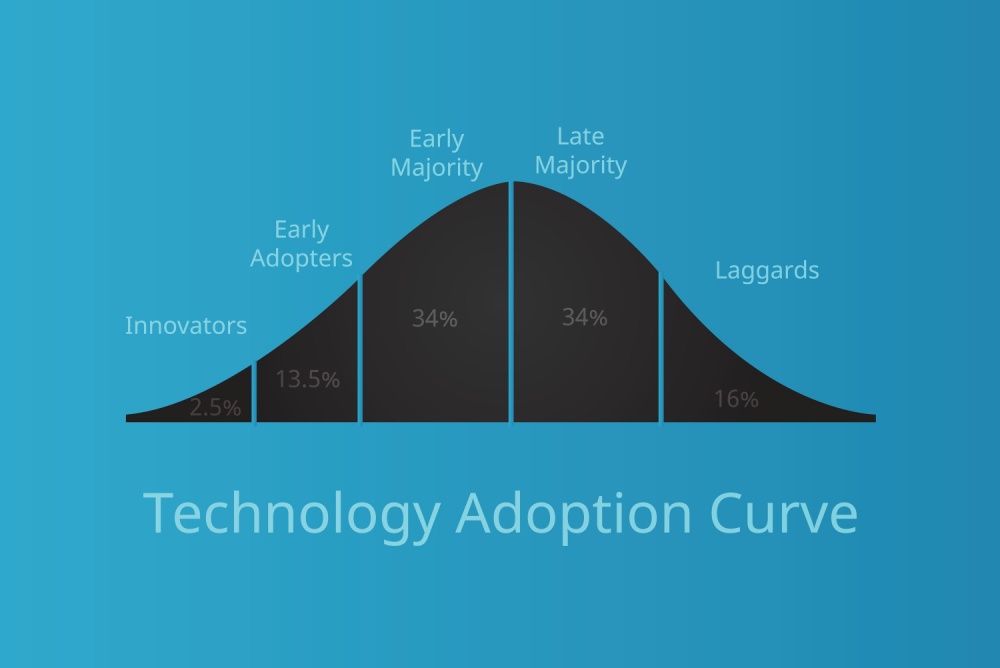

Even so, we’re still quite early in the bitcoin adoption curve.

There’s only about 1% penetration world wide, and only about 10% of Americans own some sort of cryptocurrency (which is probably bitcoin). To be honest, there are probably only a few million people in the entire world who hold a significant amount of their wealth in bitcoin.

That number is rapidly growing, but it’s still quite small.

Adoption is low for a number of reasons, namely that bitcoin is hard to understand, and it’s easy to get roped into bullshit games like altcoin chasing (2017 crash), yield chasing (2021 crash).

In other words, to buy, hold, and keep your bitcoin you need to be an educated investor, not just a tourist looking to get rich. Most people are simply too lazy to do it. Much like technology adoption of the internet, there are early adopters, but the vast majority of people come around when it’s easier to use.

You are now at this crossroads. Are you going to put in the work?

Being Early Requires Work

The benefit of being early to an investment means there’s great upside price potential. Don’t get me wrong, folks who come later to bitcoin will still be able to use bitcoin for its fundamental use case of permissionless peer-to-peer transfer and scarcity, but it’s the early buyers who will 10x or 100x their purchasing power.

Where else can you 10x or 100x your investment?

The only other place is with high risk stocks.

Your real estate investment is not going to 10x in the next 10 years, let alone 100x. Your index fund won’t either. Whatever other fractional art or fractional commercial real estate investment you heard advertised on a podcast won’t do it either. Literally nothing can except for picking amazing stocks, and that’s pretty hard to do.

There’s a TON of research and a TON of risk involved with stock picking. Finding the next 100x stock is just an insanely low possibility.

Picking Bitcoin Is Easy

With bitcoin, there is no other choice. The risk-to-reward possibilities is just unheard of anywhere else. Bitcoin is very unlikely to go to zero at this point. There are too many entrenched players. Sure, there are headwinds and risks ahead, but the risk in 2023 is nothing like it was in 2009. You might not 1000x your investment at this point, but a humble 100x would be rewarding.

As I see it, the choice is simple. Buy bitcoin, or don’t participate. You can show up later when it’s easier to use and you have permission from your financial advisor.

Never has there been such a clear opportunity to buy in early to an investment with such a great track record and upside price potential.

Related Content

2. You’re Holding A Fundamentally *Different* Asset

Even if you don’t buy into the sky high price predictions like $1,000,000 bitcoin in the next decade, another benefit of investing in bitcoin is that it’s fundamentally different from every other asset class out there.

Bitcoin is not a company, and not a stock. It’s not reliant on selling products or services earn income. There are no quarterly statements or board of investors. Bitcoin’s price is determined by supply and demand. If more people want bitcoin, then the price goes up.

Bitcoin does not rely on a single, centralized group of people, whether that be a group of founders, investors, or politicians. It’s permissionless code, meaning anyone can contribute, improve upon, distribute, and use bitcoin however they see fit.

More people using bitcoin means more people demand it. Then price goes up.

Furthermore, the price of bitcoin is often decoupled from other types of assets like the stock market and precious metals. There are periods where price is correlated, but there’s no fundamental connection because it’s a completely unrelated technology with unrelated factors driving adoption.

Unlike a tech startup, Bitcoin doesn’t rely on borrowing money from angel investors and operating a loss for years to “growth hack” its way to gaining users.

Unlike real estate, you can invest as little as a few dollars at a time, without a bunch of paperwork. Then you can take it with you in your pocket and sell a small portion at a time as you need liquidity.

Unlike stocks and bonds, you don’t need permission to own it, and you don’t need a custodian to hold it for you. You can buy and sell 24/7 and spend directly for goods and services.

Unlike art and collectibles, more cannot be produced to meet demand. There is a global, liquid, transparent, market with equal access. You what bitcoin is really worth, not just what you can get for it based on a limited local pool of buyers.

Even if you hate bitcoin, you have to admit that it’s not like anything else, and for that reason, I think it’s an obvious addition to any modern, diversified portfolio.

3. Access Your Bitcoin Instantly, Globally

Another one of the benefits of bitcoin is that you can access it anywhere, instantly. This is very underrated in my opinion.

Imagine that you invested in real estate and go on vacation. Can you sell 1% of your bitcoin while overseas to pay for a boat ride on the river? No.

Imagine that you own Apple stock and are traveling in Thailand. Can you pay the street vendor with a fractional share of $AAPL? No.

Even with cash in the bank, banks only work 9AM to 4PM, Monday to Friday. Have you ever been stuck someone with your credit cards lost and banks closed until Monday? If you had some bitcoin on your phone, you’d have instant liquidity to convince someone, somewhere to let you into a taxi or into a hotel.

Bitcoin is traded 24/7 and can use it on your mobile device. You don’t need permission to move your bitcoin.

Best of all, it can be traded peer to peer. Although bitcoin adoption is still quite low, there are plenty of hacks around this. You can buy gift cards, or there are services that allow you to spend your bitcoin by purchasing virtual visa cards via lightning. Strike is rapidly closing in on their Point of Sale collaboration which would allow you to spend bitcoin even if merchants only accept fiat.

Adoption is coming. We’re only a decade into this bitcoin experiment, and there are way more people willing to accept bitcoin now than ten years ago. Even if they aren’t a bitcoiner per se, most people realize they can sell bitcoin for a price and there’s a stable, liquid market that will accept bitcoin. Bitcoin is no longer just “money for criminals”.

Fast Transaction Settlement Times

If you need money fast, peer-to-peer bitcoin is the fastest way to transfer value between unknown people, in a trustless way.

Imagine that you need to pay someone you’ve never met before. How do you send them digital dollars?

You have Zelle and they have PayPal. It won’t work. They have Cash App and you have Venmo. It won’t work. They have WeChat and you have Chase. It won’t work. Sending digital money requires compatible payment rails to work.

What’s more, you have to trust that they won’t call their bank in 2 days and tell the bank they were a victim of fraud or deserve a refund. Claw backs are a real thing, especially for merchants.

Lightning transactions are instant and final. On chain transactions take longer, but it’s still just 30-60 minutes max, and your transaction is set in stone. No customer service department in the world can claw back that transaction.

Try get money from your bank to another bank with the same settlement assurances in the same amount of time using ACH or wire. You can’t do it.

4. Inexpensive Long Term Cost Of Custody (100+ Years)

It wasn’t until I had kids that I started thinking about handing down something of value to the next generation. It wasn’t until I started learning about bitcoin that I realized how difficult it is to do.

Every other type of investment comes with the risk of trends, taxation, and custody.

Think about real estate. Let’s say I had a property that I bought a few years ago and pay off before I had it down to my kids. Even with a fully paid off house, you are still going to owe taxes it…forever.

California is unique in that property taxes are set at the time of the purchase price of the property, and they don’t even change when you hand it down to your kids. Most places in the US and in the world are quite different, and property taxes continue to go up year after year as the value of the home increases.

Regarding stocks, do you know how many companies last more than 50 years? Not many. People often point to stock market returns compared to gold if you bought in the 50’s, but could you have picked the right company in 1950 and held it until today?

Or would you be able to hop between profitable investments every 10-20 years? Remember, each sale is a taxable event.

Bitcoin currently has the benefit of being a globally recognized asset that’s only taxed upon sale, and isn’t reliant on trends or an executive team and marketing strategy. You only have to buy bitcoin one time, and it sits in cold storage for free. Miners protect the network based on their own economic incentives, and you only pay fees to the network when you need to send bitcoin!

Seizure Resistant Asset

Bitcoin is hard to steal. If you secure it correctly and don’t succumb to social engineering, both petty criminals as well as organized ones (government) will find it very, very difficult to get your bitcoin without your permission.

The topic of being seizure resistant is often seen as “conspiracy theory”, , but, the government can literally take your assets for any number of reasons.

Thanks to civil asset forfeiture, if you’re caught anywhere with more than a few thousand dollars cash, you could be suspected of selling drugs or any other criminal enterprise requiring cash. You’ll have your money confiscated, never to be returned, or to be eaten up by lawyer fees.

Even if you have your precious metals and other stores of wealth locked up in a bank safe deposit box, they can simply be drilled open by police just for being suspected of storing criminal paraphernalia.

Or think about having precious metals and cash in a safe in your house. The wrong person with that knowledge, or a random robbery could mean loss of everything, with no repercussions.

With bitcoin, there are many safety measures to protect your bitcoin from theft by criminals, whether they wear a badge or not.

- Multisig.

- Key sharding.

- SeedXOR.

- Pins.

- Brick/decoy pins.

- Time locks.

- Passphrase wallets.

These may be unfamiliar terms to you, but they are all different types of security measures that make your bitcoin hard to get without your permission. Even without all this, as long as nobody knows your seed phrase, then the only way for them to get your bitcoin is for you to tell them.

5. Owning An Asset With Unchangeable Hard Cap Supply

The supply of every tradable asset on the planet can be increased, assuming there is enough incentive to do so.

Real estate? Build more.

Gold? Mine more.

Stocks? Issue more.

Maybe art from dead artists is the exception, but who except that ultra wealthy stores their value in Picassos.

The assets listed above have been chosen by society as stores of value because they are in limited supply, but that limitation is a tenuous one. The gold supply is limited right now because you have to make sure your gold mining operation is profitable. If gold is $2000 per oz, you can’t spend more than $2000 per ounce to mine it.

If the price of gold were to shoot up 10x to $20,000 per oz, then you could dedicate 10x more resources to mining it. That means getting more gold out of the ground, faster. At $200,000 per oz, now you’re sending submarines to the bottom of the ocean. At $2mil per oz you’re landing rockets on asteroids looking for a shiny rock. Supply expands to meet demand.

The same applies to real estate to some degree, although you can’t build two houses exactly the same in exactly the same location. However, the principle is similar. With enough economic incentive, you can build more real estate in the same relative area. Your beautiful residence could be sitting right next to a high rise residential building in 20 years if there’s enough profit to be made.

With bitcoin, no matter how high the price goes, you can never issue more bitcoin than the protocol allows for. This is thanks to the difficulty adjustment coded into the bitcoin software.

No matter how many miners plug into the network, the bitcoin issued in every block will be the same. There can only ever be 21 million bitcoin, and you can pinpoint how many bitcoin will be mined every single day until the year 2140 when no more new bitcoin can be created.

Don’t like that rule? You can fork the code, but good luck getting other bitcoiners with skin in the game and ownership of a limited asset to follow you and debase themselves.

3 Drawbacks Of Investing In Bitcoin

Bitcoin isn’t all rainbows and cupcakes when it comes to investing in and owning the asset. There are some drawbacks to investing in bitcoin you should be aware of.

1. Learning About A Completely New Technology Requires Engagement

Because bitcoin is a fundamentally different type of asset, you have to learn about it. After having many conversations with my non-bitcoiner friends, learning seems to be a bridge too far. The consensus of my friends seems to be that if it isn’t obviously an easy investment and guaranteed to work, then they’ll just stick with standard advice of investing in the S&P 500.

They don’t want to get bogged down with learning about the history of money, or how bitcoin works. They don’t want to invest $200 into a hardware wallet, and they certainly don’t trust themselves to hold their own keys. It’s just too much work!

We’re still quite early to bitcoin, and the tools to secure it and transfer it are still being developed. Only those who put in the time to understand at least a little bit beyond the surface are going to be rewarded with exponential returns. That’s the point of being early to an investment. You know something before other people do.

Then, you can’t just buy some and forget about it. Caring for your wealth requires some occasional maintenance.

If you wait for bitcoin to be easy, then the potential for outsized returns evaporates.

At the end of the day, bitcoin may not be the right investment for you, but you should at least put in the work to make an educated decision. “Bitcoin is bubble” just doesn’t cut it anymore.

2. True Self-Custody Requires Personal Responsibility

One of the hardest parts of owning bitcoin is trusting yourself to take custody of your bitcoin. Time and time again, folks have gotten rekt leaving their bitcoin on exchanges or playing shitty games chasing yield with custodians.

All along the way, there were well-known, trusted voices in the bitcoin space saying that it was safe to do so. In the end, people who had their coins on Mt. Gox, Celsius, FTX, BlockFi, and other exchanges lost their coins and they’ll likely never get them back.

When you own bitcoin, you need to trust yourself to self custody. You need to hold your own keys with the knowledge that if you screw up, your money is gone.

That means buying a hardware wallet and writing down your seed phrase correctly. You’ll probably even want to practice deleting the wallet and recovering it on a different wallet with some test funds to practice for a catastrophic scenario. You’ll want to etch or hammer your phrase into steel and get a hidden safe for it.

You may want to look into multisig solutions, which means investing into 2-3 different hardware wallets. You’ll need to check wallets once a quarter or biannually to ensure the hardware still works and you still remember how to find/use the wallet.

This is especially important if you start to move a significant amount of wealth into bitcoin.

I think about it as any other task in life regarding wealth and longevity. If you’ve ever learned how to buy a house or invest in stocks, that also took time out of your year to do it correctly. If you’ve ever learned how to exercise or eat right, that also took research and requires upkeep.

Bitcoin is no different. If you want to gain the benefits of bitcoin, you need convince yourself that you’re doing yourself a favor by investing your wealth responsibly.

3. Dramatic (But Temporary) Downturns Shake Out A LOT Of Folks

The bitcoin price is crazy, and your mood follows. One of the many running jokes in bitcoin is that Zillow website traffic spices as the price of bitcoin goes up. It means bitcoiners are getting euphoric and starting to look at luxury real estate.

It’s all fun and memes until the price crashes.

The thing about bitcoin is the the bull run brings longs of noobs, but it also brings long-time bitcoiners out from bear market hibernation. Even experienced bitcoiners get hyped during a bull market and over extend themselves.

Even long-time bitcoiner can get rekt on things like leverage, becoming forced sellers when the price doesn’t move in their favor. Some bitcoiners survive one bear market, only to forget the fundamentals and lose everything in the next.

Another common mistake is to sell your bitcoin hoping to get in at a cheaper price later. Just wait out the bear market in cash, buy the bottom, and boom – you’re back in the game. Easy, right? It doesn’t usually work out that way. Most people end up with less bitcoin.

Now I won’t give trading advice. For some people, some of the time the right move is to sell during a bear market. I’m not going to tell you to never sell.

What I am going to say is that if you bought correctly, not overextending yourself and not using money that you immediately need, you shouldn’t have to sell. If you believe the bitcoin story, and have read about bitcoin history, you should know that bitcoin has had 90% drawdowns before, then recovered, so the most likely scenario is that bitcoin will recover again.

At least, that’s the hodl mentality many bitcoiners have.

Don’t get shaken out like everyone else. Buy bitcoin expecting there to be a bear market in your future. What preparations can you make right now that will help you survive your first Bitcoin Winter?

How To Get Started Investing In Bitcoin

Now that you are aware of the unique benefits of investing in bitcoin, as well as the unique downsides, if you want to get started investing in bitcoin you need a few things.

- cash in the bank to buy bitcoin

- an account bitcoin-only exchange

- a bitcoin hardware wallet

Bitcoin investing for beginners isn’t too hard to start. Buying bitcoin is simple. Getting it into cold storage is a big step for many, but doable for 80% of people in my opinion. The hardest decision is going to be how much bitcoin to buy.

Investing In Bitcoin VS Investing In Stocks for Beginners

Investing In Bitcoin VS Investing In Stocks for Beginners

Leave a Reply