It may seem unimaginable that a single bitcoin could be worth a million dollars someday. A million dollars is a lot of money, and bitcoin is just some digital funny money. It’s not even backed by anything! Recently there was a very public bet that that bitcoin would reach $1 million dollars in 90 days, and although that timeline was ridiculous from the outside, it sparked the question in many minds – is a price that high even possible?

If bitcoin is not worth 1 million dollars, then the next question should be – how much is it worth? Most people can’t come up with a valuation, or their valuation is suspiciously close to the current price. In 2011, they might have said around $100. In 2017, they might have said $1,000. In 2021, they might say bitcoin is worth about $100,000.

So, what’s stopping it from being worth $1,000,000 a couple of years down the road?

Personally, I think a single bitcoin is worth way more than a million dollars. In fact, I think bitcoin’s price will go up forever. The idea is pretty simple. Dollars are infinite. Bitcoin is finite. If you measure bitcoin’s value in dollars, we know for a fact that the value of the dollar will go down forever, so bitcoin’s price will have to move in the opposite direction.

The traditional economic system says that in order to achieve price stability, they have to artificially create inflation, with a target of 2%. That doesn’t seem like much, and we may not notice it on a yearly basis, but 2% over 10 years is 20%. Over 50 years is 100%. Over your lifetime, the money you saved in your early 20s will be worth nothing by the time you are in your 70s. It’s the classic story of boiling the frog slowly.

Of course, a dollar won’t be worth “absolute zero”. It’ll still be able to buy stuff. Just way less than before compared to how hard you had to work for it. For example, let’s look at 1970-2021. That’s a span of 51 years. In 1970, the minimum wage was $1.60. That means you had to work one full hour just to earn a dollar and a half. That’s the cost of a bottle of coke in a vending machine in 2021.

If you’re at a football stadium, a single beer costs $15, so a full day of work in 1970 couldn’t even buy you a single beer at a game today.

By design, the dollar doesn’t hold its value over time. The price of Coca-Cola will continue to go up forever.The price of beef will continue to go up forever. The price of housing will continue to go up forever.

The thing that Coca-Cola, beef, and housing have in common is that they are limited in supply. You can’t create a steak from nothing. It requires time to grow the crops, and food energy plus human labor to raise the cow. It requires money to pay the butcher and gas for the trucks to ship it to your local store. You need real-world resources to make a steak.

Contrast that with dollars, which only require a keystroke to make more.

Bitcoin is similar to Coke, beef, housing, in that it cannot be created from nothing. Although it’s digital, its supply is limited. Bitcoin, like other commodities, requires “proof of work” to be created by miners. Bitcoin miners must consume real-world energy like hydroelectric power, natural gas, and geothermal heat to run their ASICs. You can’t just push a button and make more bitcoin.

What makes bitcoin unique among commodities is that you cannot create more bitcoin than is set by the block reward epoch, no matter how hard you try.

Contrast that with the housing market. As the price of houses goes up, builders will start making more houses because it’s more profitable to do so. Even though houses are hard to build, at the right price, you can build as many as you need. Though it takes lots of work, technically there’s no limit to the number of houses you could build. Eventually, supply will meet demand.

Bitcoin is different. Thanks to the difficulty adjustment, even if bitcoin gets really expensive due to high demand, you can’t make more than is allowed by the block reward. Right now, that’s 6.25 bitcoin per block, every 10 minutes. There’s absolutely no way to make more bitcoin than that, no matter how much computing power you dedicate to mining.

Considering that there’s infinite demand for money, the supply of bitcoin can never meet demand. Let’s recap.

- The purchasing power of a dollar will go down forever.

- You can’t inflate the total supply of bitcoin.

- You can’t produce bitcoin faster than the predetermined schedule allows, no matter how much demand there is.

Yes, Bitcoin Can Reach $1,000,000

Can bitcoin reach $1 million dollars? Yes, I think it can. Absolutely. In fact, I think $1,000,000 is just going to be another milestone like $1, $100, $1,000, $10,000, and soon to be $100,000. There’s nothing magical about a million dollars. It’s just a number, and the human brain attaches special significance to it.

In my opinion, what’s important to look at is the value of time and energy. Buying and owning bitcoin will allow you to have more purchasing power in the future. When I exchange my labor for value today, I want to store that value in something that will retain purchasing power in the future. If I work for dollars, my purchasing power will go down over time. If I work for bitcoin, my purchasing power will increase over time.

I think it’s inevitable that a single bitcoin will cost $1,000,000 in the future. The question isn’t if, the question is when.

Where Does Bitcoin Get Its Value?

You might still think that a $1,000,000 valuation is still crazy for bitcoin since it’s not even backed by anything!

I think the first question to ask is why does the dollar have value, and what is it backed by? The truth is, the dollar isn’t backed by any kind of commodity either. You could say it’s backed by the petrodollar system, or “men with guns”, but it’s not backed by gold or anything like that. It’s just what we use, and we expect it to be accepted everywhere. I like to have dollars in my bank account because I know I can use them to buy things I need.

If bitcoin was more widely accepted, would it be easier for you to see bitcoin as having value, or is its pure digital nature still hard to wrap your mind around?

Then, ask yourself, why does Facebook have value? Their company is currently valued at over 1 trillion dollars. If you counted up the value of all their computer server hardware, and all their office chairs, and all their electric scooters, the value of that equipment would certainly not even be remotely close to 1 trillion dollars.

They are worth that much money not because they are backed by some kind of physical commodity. In fact, Facebook doesn’t actually exist in the real world. Facebook, the “place”, only exists online.

The reason Facebook is worth that much money is because of the service it provides. People want to use Facebook because it does something to enhance their lives.

Bitcoin is similar. Bitcoin has value because it does something. Bitcoin allows me to own digital money which cannot be debased. Bitcoin allows me to transfer units of value across the globe without a 3rd party verifying the transaction. Bitcoin allows me to securely and privately store wealth, then take anywhere in the world just by memorizing 12 words. Bitcoin allows for online microtransactions and cross-platform value transfer.

If I want those services, I need to own units of bitcoin to participate. That’s where the demand side of bitcoin comes from: verifiable, digital, limited supply store of value, and programmable global money transfer. Anything with limited supply and some amount of demand will have a price. Bitcoin is currently priced at $43,000 USD, but I think eventually it’ll be worth over $1,000,000 USD as demand remains constant or increases.

Bitcoin has some clear advantages to other assets, and as people begin to figure that out, not only will they buy more bitcoin, but they’ll also start to pull money from other assets to put it into bitcoin.

Related Content

3 Ways Bitcoin Can Reach $1 Million USD Per Coin

1. Replace Gold As The Dominant Store of Value

Personally, I think the most obvious way that bitcoin could reach $1,000,000 in value is by replacing gold as a store of value. Right now, gold has multiple uses. It’s used in jewelry and decorations. It’s used in industry for computers and aerospace. It’s also used as money, because it can “store value” well. It’s impossible to make more gold without lots of work to mine it, and it has 2,000 years of history as a way to store and exchange value.

The 21st century world is much different than 2,000 years ago. It’s more connected, and the economy thrives on the internet. Gold’s physical nature makes it impossible to send and receive online. For the past 30 years, we’ve been stuck using credit cards and bank transfers to fill that gap. Now that we have bitcoin, we can take advantage of the best of both worlds: a limited supply commodity AND a digitally native currency.

There are many reasons to own bitcoin, but I think the most powerful one is that it’s a type of money that cannot be debased by governments. You know how many units there are, and there’s no way to change that, no matter how politically popular it is for any individual or party. It separates money and state once and for all.

In many western countries, we take for granted that our money is stable in that it “only” loses 2% purchasing power per year. Many other people in the world have experienced multiple currency collapses over their lifetime. 1.2 billion people are currently experiencing double digit inflation rates, meaning the value of their money will inflate to zero in 10 years or less. Bitcoin is a globally accessible store of value with no barrier to entry. All you need is a mobile device, which you can buy for less than $50 on the second-hand market. You can protect your bitcoin simply by not telling anyone you own it and keeping your seed phrase secret. You can take it anywhere in the world simply by memorizing 12 words. You can trade it with anyone, peer-to-peer over the internet, without a company in the middle.

For all of these reasons, Bitcoin is a better store of value for the modern world.

Not only will Bitcoin subsume at least some of the current gold market, it will open up a brand new market for the unbanked. Currently, 2.5 billion people don’t even have a bank account, so it’s unlikely they could afford a single gold coin. However, you can buy a fraction of a bitcoin for less than a dollar, and you can earn a fraction of a bitcoin doing online work. Those things are just not possible with gold, so bitcoin opens up a brand new market of HODLers.

Gold’s market cap is currently 11 trillion dollars, while Bitcoin’s market cap is around 1 trillion. Though we can’t expect bitcoin to fully replace gold, it’s safe to assume that it will take a portion of its share of the “store of value” market, and also attract new participants. Considering that more people don’t own gold than do own gold, I don’t think it’s unreasonable to see bitcoin matching gold’s market cap and reaching a price of 10x where it is now, which would be $500,000 per coin.

2. Replace Bonds As Safe Asset

Who actually owns bonds these days? OK, well apparently lots of people do because the global bond market has a market cap of over 100 trillion dollars. Though very conservative institutions with mandates about risk, and a portion of the average investor population over a certain age do own bonds, I don’t think that trend is going to last very long.

Just consider the original reason for owning bonds. High quality bonds are supposed to be a safe place to park your money for a flat rate of return, without all the risk of equities. While the safety aspect of highly rated corporate and sovereign bonds is still intact, the return part is not. Considering that interest rates are extremely low right now, most bonds return negative real yield, meaning that the amount they pay you does not keep up with inflation.

That means you are putting your money at risk for the pleasure of losing purchasing power over time when you adjust the return for inflation. While larger institutions can stomach those kinds of losses and may not have a choice due to investment mandates, your average investor will not. Though typical CPI is quoted as 2-3% historically, in 2021 we are seeing as high as 5% inflation using this metric. Of course, once you start to look at assets not included in the CPI, we see price increases of 10% or more. Your bond return of 1-2% is starting to look pretty bad.

Personally, I have never owned a bond, and will never own a bond for this reason. I’m sure many others my age are in the same boat, and more will join. The question is, where do we end up putting assets that would have otherwise gone into the bond market?

Equities carry a lot of risk, and we may already be exposed to them via “safe” index funds. In fact, I think you could make the case that index funds are the new bonds. People buy them as a safe vehicle to keep up with or slightly outpace inflation. Although index funds are marketed as a safe vehicle, they still carry more risk than holding your money in cash or bonds.

So, if we want to diversify away from equities, where do we put our money? Buying individual real estate comes with its own problems, including price as a huge barrier to entry. You can invest in REITs, but then that exposes you to more 3rd party risk, and requires that you become somewhat of an enthusiastic investor and money manager, which many people don’t want to, nor have the time to do.

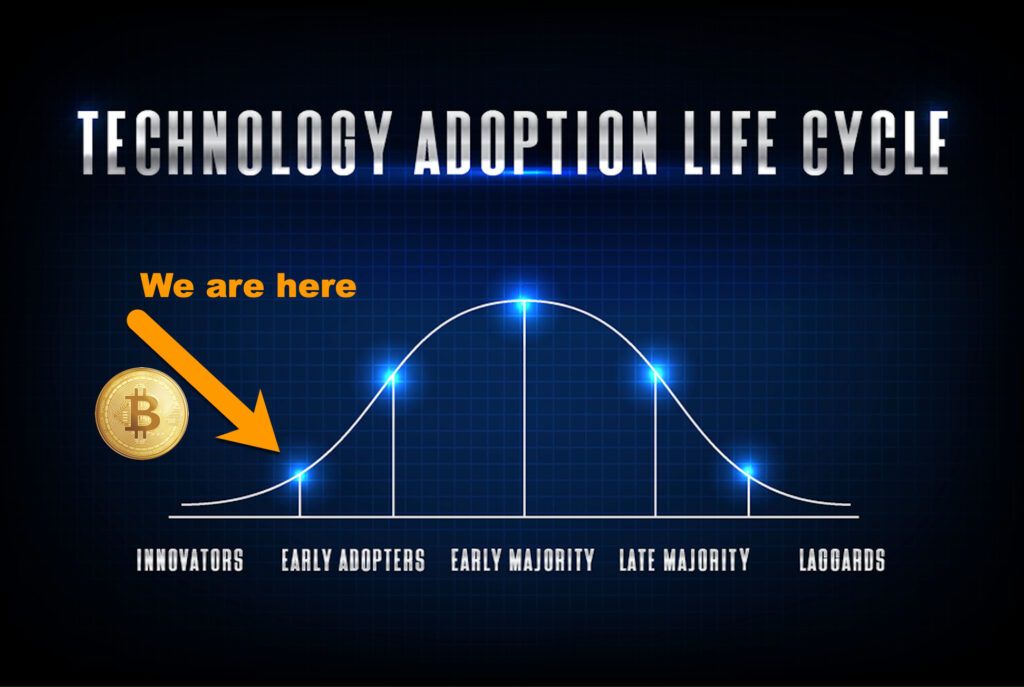

Beyond that, your investment choices get more and more esoteric, requiring specialized knowledge to be successful. This is why I think bitcoin makes an excellent choice for people who find themselves in this boat. Of course, bitcoin is seen as “very risky” right now, so not a lot of people are willing to do the research and take on that risk. However, the market is changing, and options for bitcoin ownership are proliferating.

10 years ago, if you wanted to buy magic internet money, you’d have to send cash to Japan and hope someone on the other end received it and would send you bitcoin. You had to run your own node and know how to self-custody your bitcoin. It was new. It was complicated. It was risky.

Bitcoin is a lot more mainstream now, and there are many more custodial options. You can:

- use a hardware wallet for cold storage

- download wallet apps directly to your phone from the app store

- use multisig for high-level security

- do collaborative custody where you hold one key and a trusted institution holds another

- purchase offline cold storage vault options as a service

In the near future, you’ll be able to purchase and store bitcoin directly in your bank. It’s getting faster, easier, cheaper, and safer to hold bitcoin. So when you think about whether to buy a bond yielding 2%, or bitcoin yielding 200% CAGR, it’s logical that at least a portion of people will allocate a portion of their investments to bitcoin.

What makes this kind of investment even more attractive, is that when you own bitcoin, you can then use that bitcoin as collateral for a loan. That means you can get fiat money without selling your bitcoin and having to pay capital gains taxes by selling. The same is not true with bonds or equities.

As bitcoin gets easier to safely own and others gain confidence in it as an asset that’s here to stay for the long term, global demand will rise. The question is then, how many investors will start asking themselves, “Why would I want to own a bond, when bitcoin has all of these other advantages?” If that number is just 10%, that’s ten percent of a 100 trillion dollar market or 10 trillion dollars. That’s 10x from where we are now, which would be $500,000 USD per coin.

Of course, I can’t predict how fast or how much of the bond market will actually move to bitcoin, but I’m just ballparking some numbers. So far, with $500k from gold, and $500k from bonds, we’re already at $1,000,000, and that doesn’t even account for money being absorbed from other asset markets.

3. Global Demand Is On The Rise

The global demand for bitcoin for any reason is on the rise. The cool thing about Bitcoin is that it has many uses, so each person buying or selling bitcoin will have their own reasons for doing so. Some people are using it to store value, while others are using it to transact globally. With recent developments in lightning, a growing number of users are getting into bitcoin to listen to podcasts, send private text messages, and play video games.

What’s cool about Bitcoin is that because everything is on a public ledger, you can actually see data showing this growth in bitcoin usage.

Here’s an interesting chart showing that wallet addresses with a small amount of bitcoin have continued to accumulate throughout the years, while big buyers took a pause, then jumped in over the winter of 2021.

Another cool public chart here shows that entities who are buying and not selling bitcoin is growing. This is a great metric because it shows that these are not “lost coins” which will just sit there forever. These are bitcoin buyers with high conviction. They are buying bitcoin no matter the price movement, especially when it goes down (buy the dip)!

The reason bitcoin is growing and will continue to do so is because there’s nothing else like it. It’s literally impossible to make another bitcoin, and we have front row seats to the bitcoinization of the global economy. Bitcoin reached a trillion dollar market cap faster than any other tech company ever, and it’s not stopping!

4. The Models Say So

I’m not a big believer in modeling out bitcoin movements to the future, but models are fun to look at. Personally, I think there are just too many variables in the world to map any bitcoin movement onto some kind of programmatic schedule.

For example, many of the charts you see below make the case that we’re on the cusp of a large move in bitcoin price for Q4 2021. Ready for liftoff! However, a global financial crisis hitting right now would probably wreck all risk-on markets like in March 2020, invalidating many of these models.

Even so, the saying goes that all models are wrong, but some are useful. Basically, that means you cannot expect a future-predicting model to be perfectly on point every day of the week. Models are just ways of mapping out bitcoin’s price history in such a way that you can analyze the possibilities of what may happen in the future.

If that’s the case though, then the only model I need is Number Go Up. I believe bitcoin will increase my purchasing power over time due to its unique properties and utility. In between now and then, it doesn’t really matter how the price moves.

That being said, let’s look at some hopium charts.

$500,000 by 2022

III Captial makes the case that $500,000 bitcoin is a conservative estimate by mid-2022. If we really do reach $500k by next year, then I think million-dollar bitcoin is absolutely within the cards in the couple of years after that.

Polar Coordinates: $1,000,000 by 2026

An interesting new chart that’s come out is the “polar coordinates” chart, showing time and price on a log scale, represented in a circle. A circle is used to show bitcoin’s cyclical nature due to the halving process. In this chart, you can see that a price of $100,000 (105) is due for 2022, then $1,000,000 (106) by 2026.

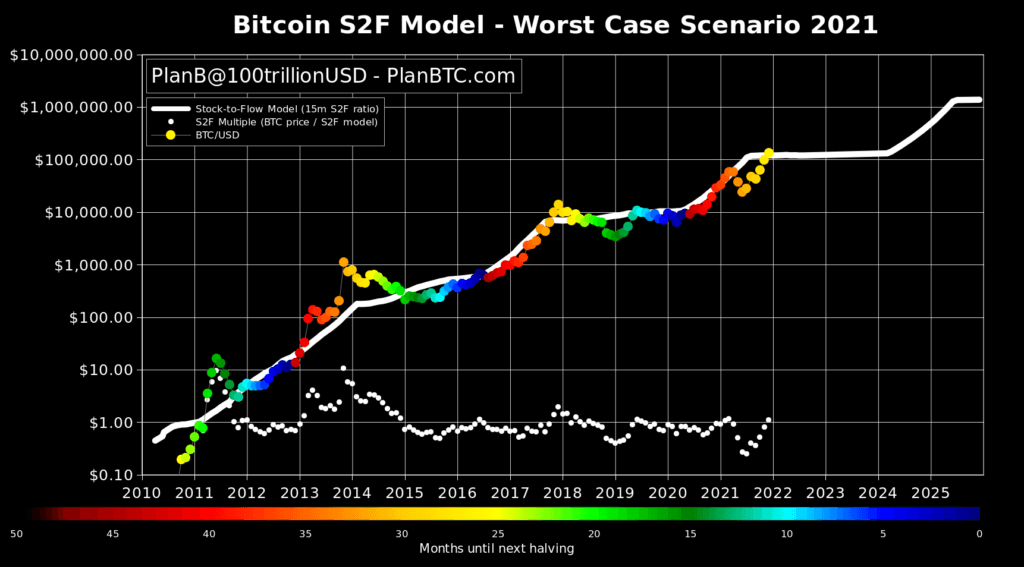

S2F Model: $1,000,000 by 2026

Of course, the most famous model is Plan B’s Stock-to-Flow model, which takes a page from the book of precious metals by comparing the “stock” (available coins) to the “flow” (new coins being mined). Looking at the model’s history, you can see how bitcoin’s boom and bust cycles map onto the increasing stock vs reduced flow. Eventually, bitcoin’s stock-to-flow will approach infinity as new coins stop being mined and the full supply of 21 million coins becomes realized.

Of course, past performance is no indication of future returns, so we’ll see how this model actually plays out for the rest of 2021.

This particular image from Plan B is a prediction for the months of August, September, October, November, and December of 2021. Based on the model, his prediction is that by December we’ll be at $135,000, and after 2025 we’ll hit somewhere near or above $1,000,000.

$1,000,000 by 2023

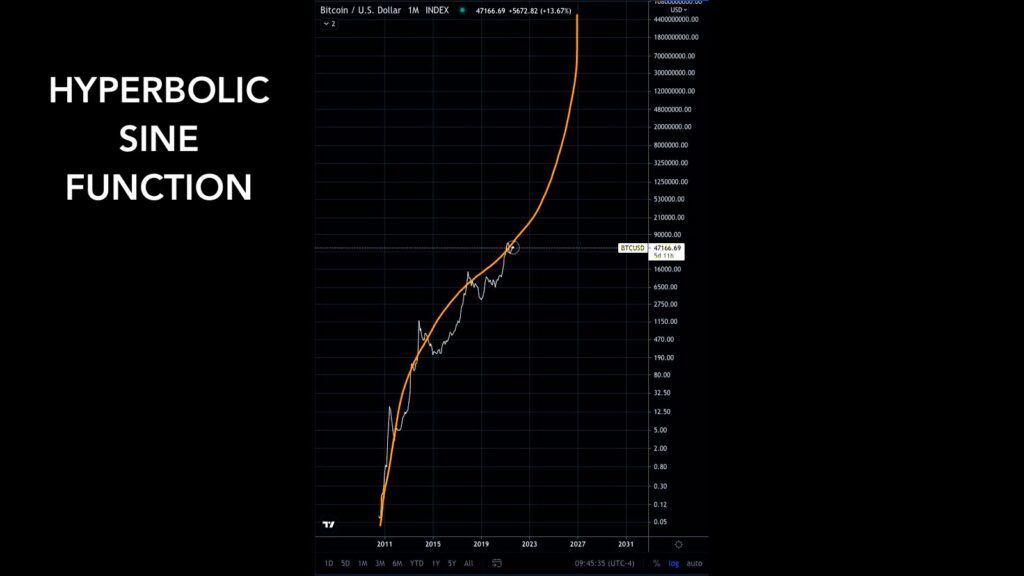

The hyperbolic sine function is a new one, and I’m not really sure of the story behind it. It’s a sweet-looking line though. I’m pretty sure this is just speculation, and “what if” type of modeling, and there’s not a whole lot of meat behind it. I think getting something like this to play out would require a pretty substantial event to change the course of bitcoin – and the world, in a violent way.

Update 2023: This one is looking increasingly out of touch. Sorry Balaji.

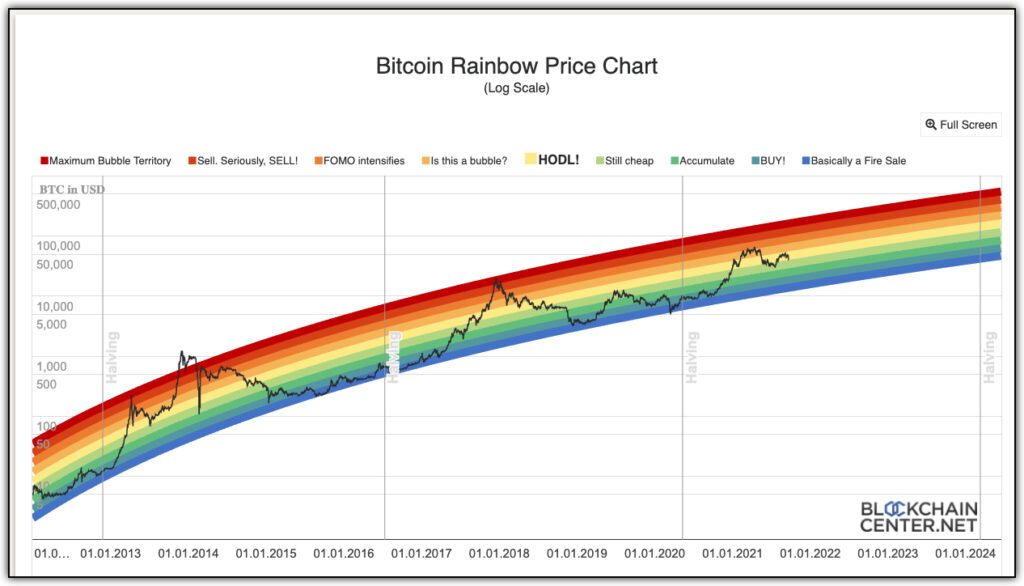

Rainbow Chart: Logarithmic Regression

Another famous chart worth considering is the rainbow chart. This isn’t as popular as the s2f model, but maybe that’s because it’s less bullish. The rainbow chart basically says that bitcoin still has a lot of room to run, but it’ll take longer to get there. Basically, it says that the initial couple years of gains were insane, but future gains will be comparatively lower as we lose steam due to Bitcoin saturation.

Nobody needs to “discover” bitcoin anymore. Everyone is aware of it, and only some people will decide it has utility. The rainbow chart is useful when looking at the colored bands, so you know when to buy and when to sell.

This chart doesn’t say when bitcoin should reach a million dollars, but you can extrapolate out past 2030 because we’ll barely hit $500,000 by 2025, even with speculative mania and a blow off top.

Final Thoughts

The chart stuff is fun to look at because it’s visual, but as the saying goes, no models are accurate, but some are useful. They are a good way to think about how things could play out in the future, but really nobody knows what’s going to happen. You can relate bitcoin price movements to anything from seasonal male testosterone to phases of the moon.

Realistically, I think the best chance that bitcoin has of getting to a million dollars is by absorbing a portion of value from every type of financial market. There are advantages and disadvantages to every asset, and bitcoin has some very interesting tradeoffs. Every investor will now have to consider those tradeoffs as they decide where to put their money because we know with 100% certainty that fiat cash will lose value over time.

How long will it take?

In my opinion, it’s pretty inevitable that bitcoin’s price reaches $1,000,000 sometime in the next decade. Just ballparking a little bit of growth in public and institutional interest, plus a new group of investors jumping into the fray as they become adults, I don’t think it’s unreasonable to see a 20x growth in ten years. That includes two halving cycles, where historically we’ve seen tops at 112x from the cycle bottom, and end cycle multiples of 13x and 54x.

I’m not making a price prediction for an exact number or multiple. I’m just saying that the price today is $50,000, and a 20x multiple across two halving cycles is not that crazy. Beyond a million dollars, price targets get even wilder, but I think anything is possible with bitcoin!

More Million Dollar Price Predictoins

Frequently Asked Questions

What Will Be The Price Of Bitcoin In 2030?

Nobody knows what the price of bitcoin will be in 2030, but there are plenty of people guessing. The most common estimates are somewhere between $100,000 and $1,000,000 USD. Not only are these guesses based purely in speculation, they also fail elaborate on what the purchasing power of $100,000 or $1,000,000 would actually buy. Inflation is raging and compounding, so by 2030, a hundred thousand dollars or even a million dollars might not buy that much.

What’s The Highest Price Bitcoin Can Reach?

There is no highest price or maximum price that bitcoin an reach. Since it is a fixed supply, as long as demand keeps increasing, the price can go up forever. The price of bitcoin is relative to purchasing power, so although the dollar amount could be higher than most people expect, the real way to track increases in bitcoin’s price is to look at how much stuff you can buy with it. The value of fiat currencies are continually being devalued against hard assets, so you need to price bitcoin in much more stable asset values.

How Many Bitcoin Are Left?

As of 2023, there are about 2 million bitcoin left to be mined. New bitcoin are released on a schedule of 6.25 bitcoin every ten minutes.

How Soon Could Bitcoin Reach $1 Million Dollars?

Bitcoin could reach a price of a million dollars in just 1-2 years if it follows historical patterns of rapid price appreciation during bull markets. Compared to previous runs of 100x or more, a “small” 35x from today’s price of $30,000 would put us at a price of over 1 million dollars per bitcoin.

3 Ways To Gift Bitcoin For Non-Experts!

3 Ways To Gift Bitcoin For Non-Experts!

Leave a Reply